Information Disclosure Based on TCFD

The Olympus Group recognizes that climate change is a serious issue that threatens the global environment, as well as having grave implications for the group's business activities. Based on this awareness, we announced our endorsement of the Recommendations of the TCFD in May 2021, as a part of our contribution to building a carbon neutral society and circular economy in our Corporate Strategy. According to the TCFD's recommendations, the Olympus Group will disclose its climate-related financial information in a timely manner.

Governance

| Disclosure items |

|

|---|

Sustainability activities of the Olympus Group are overseen by the ESG Committee, which deliberates on and makes decisions regarding important measures. The ESG Officer has ownership of the Committee, the membership of which is comprised of the heads of each Business Unit and Functional Division. Details of decisions of the ESG Committee are reported to the Group Executive Committee and the Board of Directors, both of which provide advice and guidance to the ESG Committee to ensure the effectiveness of the process. In addition to implementing sustainability strategies and reviewing important issues related to materiality, the ESG Committee has established themed working groups under their supervision, including those for the environment and human rights, to consider and share information on measures that require cross-functional initiatives.

Responses to climate change for the entire Olympus Group are overseen by the Chief Human Resources Officer (CHRO), who has authority over environment, health, and safety (EHS) functions, under the CEO, who has final jurisdiction over matters related to environmental activities. Under the Environmental Health and Safety Policy, which is applied to the entire Olympus Group, the EHS coordination function formulates an Environmental Action Plan for the Olympus Group as a whole in accordance with the ESG targets set out in the medium- to long-term business plan, and monitors the progress statuses for that plan while promoting continuous improvements. In response to progress reports, the executive officer responsible for the environment (the CEO) give instructions for any improvements required. Also, to reinforce the commitment of management to the ESGs and climate change initiatives, some of the executive officers’ performance-based stock remuneration, a part of our long- term incentive remuneration, is linked to the evaluation results of an external ESG evaluation organization.

Environmental Health and Safety Policy

(CDP alignment: C4.1.2、C4.2、C4.3、C4.3.1)

Strategy

| Disclosure items |

|

|---|

The Olympus Group identifies risks and opportunities related to climate change by using scenario analysis. The influence of climate change on our business activities is analyzed based on 1.5-degree scenario: RCP 1.9 (NZE) (keeping the increase in the global average temperature to below 1.5° C above pre-industrial levels), and the 4-degree scenario: RCP8.5 (where the increase is assumed to be up to 4° C above pre-industrial levels), both of which were presented by the International Energy Agency (IEA). We identified that the major risks in short-term (one to five years) would be the suspension of factory operations, breakdown of supply chains due to natural disasters, or impairment of stakeholders’ assessments or Group’s reputation with stakeholders due to inadequate responses to climate change or insufficient disclosures; and the risks within the medium- to long-term period (5 to 20 years) would be an increase in business costs due to the introduction of carbon taxes and further tightening of greenhouse gas emissions regulations.

Although such climate change risks could affect our corporate strategy and financial plan, we assume that the scope of impact would be relatively small. As a transition risk, an increase in operational costs accompanying the introduction of a carbon tax, etc. can be expected in the future. However, the impact of this is assumed to be limited as energy costs at factories are minor when considered in terms of overall operational costs. For example, the geographical location of our factories in terms of natural disasters, such as typhoons, can be classed as a physical risk. We confirmed that our factories are at low-risk locations and a business continuation plan for each site has been created in case of emergency. In terms of supply chains, storms and flooding have occurred on a global scale recently and are expected to have impact on material procurement and product supplies, and accordingly, we are working to establish systems that can ensure production through alternative suppliers.

As a climate change opportunity, we will continue development of environmentally conscious products with energy- saving and other functions, taking the rising requirement for such products, which contribute to greenhouse gas emissions reduction, as a business opportunity. However, we estimate the impact from this opportunity on our business will not be so large because the majority of our products are already small with low energy consumption, and the nature of our products and services are relatively independent from any impact from climate change.

(CDP alignment: C2.1、C3.1、C3.1.1、C3.6、C3.6.1、C5.1、C5.1.1、C5.1.2、C5.3)

List of risks and opportunities based on scenario analysis

| Scenari o | Risk or opportunity item | Social change, impact on business | Degr ee of impa ct | Time axis | Main initiatives | |

|---|---|---|---|---|---|---|

| 1.5℃ | Transitio n risks | Policy and laws | Expanded regulation or increased obligations concerning existing products, business activities, and information disclosures | Medi um | Short term |

|

| Expanded carbon taxes and emissions trading* | Small | Medium term | ||||

| Changes in technology | Reduction of sales opportunities if the transition to low- carbon manufacturing methods and materials is delayed | Small | Long term |

|

||

| Changes in markets | Increased costs for energy including fuel needed for business activities as well as raw materials and logistics | Small | Medium term |

|

||

| Reputation | Impairment of stakeholders’ assessments or the Group’s reputation with stakeholders due to inadequate responses to environmental issues | Medi um | Short term | |||

| Opportu nity | Resource efficiency | Lower costs for raw materials and waste as a result of reviewing products and packaging | Small | Medium term |

|

|

| Energy sources | Improvement of stakeholders’ assessments or the Group’s reputation with stakeholders due to cost reductions from higher energy efficiency or broader use of low-carbon energy | Small | Short term | |||

| Products & services | Improved market competitiveness due to development of environmentally-conscious products | Small | Long term |

|

||

| Markets | Improvement of stakeholders’ assessments or the Group’s reputation with stakeholders due to promotion of environmentally-conscious products | Medi um | Short term | |||

| Resilience | Expansion of business that ensures adaptability to climate change | Small | Medium term | |||

| 4℃ | Physical risks | Acute | Disruption of supply chains due to more severe natural disasters | Medi um | Short term |

|

| Chronic | Higher air conditioning costs due to rising average temperatures and lower labor productivity due to changes in the physical condition of employees | Small | Medium term | |||

* Projected financial impact calculated based on the carbon tax price in 2030 noted in the World Energy Outlook 2024 report by IEA, in the absence of a strategy to address the issue: approx. 900 million yen/year

Timeline: Short term: 1–5 years; medium term: 5–10 years; long term: 10–20 years Level of impact: Calculated based on a three-level system, from the perspective of financials, operations, stakeholders, and legal compliance.

Degree of impact: Amount of financial impact and three-stage assessment from the perspectives of operations, stakeholders, and compliance

Risk Management

| Disclosure items |

|

|---|

The Olympus Group has established enterprise risk management methods and approaches to support the achievement of its business objectives, such as its corporate philosophy and corporate strategy. Based on these methods, we collate risks with the potential to impact the Olympus Group’s business within the framework of management of all risks and opportunities which affect our business and then identify and evaluate those risks with a high impact on business operations. These risks include regulations relating to the environment including climate change, technology and other transition risks, and physical risks resulting from natural disasters.

Identified risks are evaluated and prioritized by each organization based on the degree of impact in the case where a risk materializes and the possibility of occurrence, and based on the results, we formulate single-year and multi-year business plans to manage the risks. Regarding risks relating to environmental laws and regulations, the quality control function monitors developments concerning those environmental laws and regulations related to our products, and the environmental division of each company monitors regulatory developments relating to their business sites, and each periodically evaluates the status of compliance, and takes measures as necessary.

To address those risks that could have a particularly substantial impact on business operations, we periodically monitor the status of organizational risk management and report the results to the Group Executive Committee and Board of Directors. The CEO receives reports on the results of monitoring of the status of risk management, and if measures are ineffective, directs a review of the action plans.

Indexes and Targets

| Disclosure items |

|

|---|

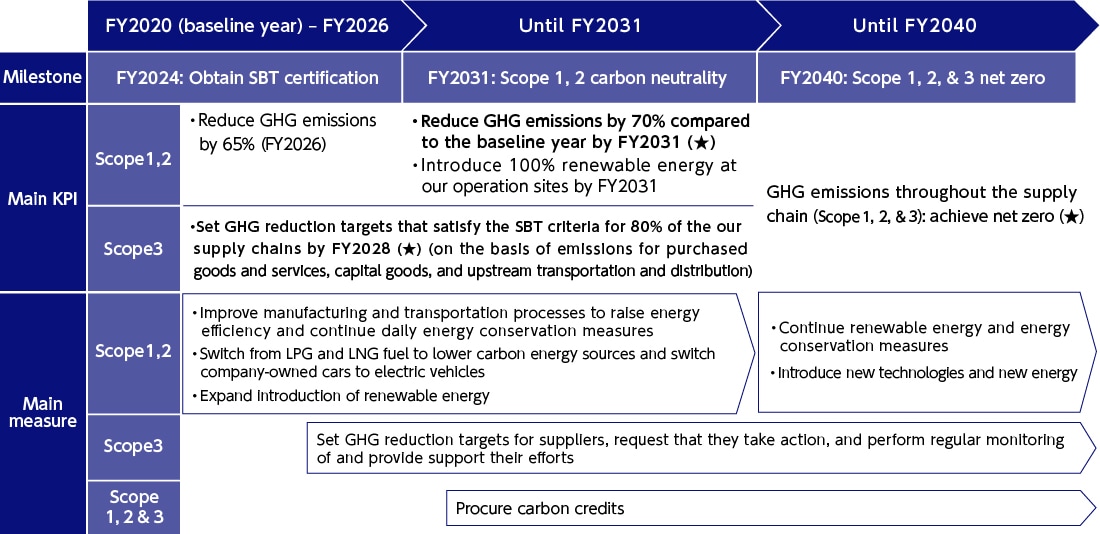

The Olympus Group set a target of achieving net zero greenhouse gas emissions (Scope 1, 2, and 3) throughout the entire supply chain by FY2040 and in October 2023 received certification from the Science Based Targets initiative (SBTi) that our net zero target and short-term targets are consistent with the 1.5° C target.

Targets Certified by SBTi

| Net zero target | Achieve net zero GHG emissions (Scope 1, 2, and 3) throughout the entire supply chain by FY2040 (baseline year: FY2020) |

|---|---|

| Short-term targets | Reduce GHG emissions (Scope 1 and 2) by 70% compared to FY2020 (baseline year) by FY2031 |

| Set GHG reduction targets based on scientific criteria by 80% of our suppliers by FY2028 (on the basis of emissions for purchased goods and services, capital goods, and upstream transportation and distribution) |

In FY2025, we reduced Scope 1 and 2 greenhouse gas emissions by approximately 62% compared to the baseline year (FY2020) and regarding Scope 3, approximately 30% of suppliers (based on transaction amounts) completed setting science-based greenhouse gas reduction targets.

To achieve our greenhouse gas reduction targets, we will improve manufacturing and further switch to and introduce renewable energy at sites in countries around the world and continuously implement measures to develop environmentally-conscious products, improve logistics efficiency, set voluntary greenhouse gas reduction targets in cooperation with suppliers, and support decarbonization initiatives.

CDP, an international non-profit organization, has recognized Olympus initiatives pertaining to the field of climate change as well as the company’s transparent information disclosure with its top rating, placing Olympus on the CDP 2024 Climate Change A List.

(CDP alignment: C5.1, C5.1.1, C7.6–C7.8, C7.9, C7.52–C7.55)

See the following for details.

Please check our latest situation in the sustainability pages.